The Fibonacci Retracement

For those of you who are forex traders, surely you will be familiar with the name Fibonacci retracement, right?

Fibonacci is a popular indicator for both forex and commodity traders because this analysis tool can provide information such as support and resistance levels that other forex indicators do not have.

Using the Fibonacci retracement itself is quite easy. This indicator will highlight areas where a pullback could reverse towards the direction of the trend and then help confirm entry points if using a trend trading strategy.

In general, Fibonacci helps trading by isolating pullbacks when they are about to expire. By taking advantage of a situation like this, you will get an estimated entry point to immediately take the opportunity.

This ratio calculation produces numbers that can help you determine entry and exit levels.

Although it can stand alone, Fibonacci can be combined with other indicators to provide maximum results.

However, before starting a further discussion about using the Fibonacci retracement indicator, let's first look at the history of the originator of this most popular trading tool.

Fibonacci's Invention and History

Do You Know Fibonacci's History?The originator and history of Fibonacci

Leonardo da Pisa, better known as Leonardo Fibonacci, was an Italian mathematician who discovered the Fibonacci numbers. He is also best known for his role in introducing the Arabic numeral writing and calculation system (algorithm) to the European world.

His father, named William, is more commonly known as Bonacci, so Leonardo has the nickname Fibonacci, which comes from the word Filius Bonacci, which means son of Bonacci.

Fibonacci wrote many books, where one of the most famous and early milestones in the use of Arabic numerals was "Liber Abaci". In chapter 12 of the book, there is a problem that is able to disturb the common sense of mathematicians regarding the problem of rabbits multiplying.

To answer this simple question, it takes more thoroughness and foresight to think.

"How many pairs of rabbits breed in one year if it starts with a pair of rabbits (male and female) and the rabbits grow into adults and mate after they are one month old, so that every second month, each female rabbit always gives birth to a new pair of rabbits."

From the results of this problem, Fibonacci finally introduced the number series 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, etc., where this ratio exists in proportion to the forms in nature and becomes the basis for the formation of these Fibonacci numbers.

Then, in the series, they found a ratio that is quite often found in every form of object that exists in nature, where the ratio of 1:1.618 or 0.618:1 is better known as the Golden Ratio.

Not a few traders, in the end, use this Fibonacci ratio as a measuring tool to get areas that can be used as a reference to take positions that "potentially generate profits" in their trading.

Then, how to use Fibonacci in forex trading?

How to Use Fibonacci in Forex Trading

How Fibonacci Works in Forex Trading

To use this tool, you don't need to be a mathematician to be able to calculate the Fibonacci ratio for every trading transaction that will be made.

By using this Fibonacci retracement indicator, you can determine the range of potential support and resistance areas quite easily.

In addition, the Fibonacci retracement can also be put to good use when the market is trending, either in an uptrend or downtrend. However, this indicator will be less effective if applied to a market that is in a sideways condition.

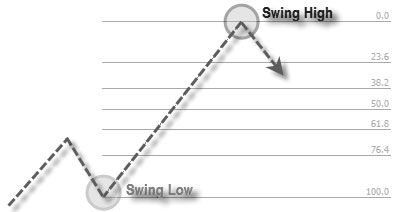

In order to find Fibonacci levels, you must first find significant highs and lows. We call these points swing highs and swing lows.

1. High Swing

In market movements during an uptrend, all you need to do is pull the Fibonacci retracement from swing low to swing high, as you can see in the example image below.

2. Swing Low

Conversely, if the current price movement is in a downtrend, all you need to do is pull the Fibonacci retracement from the swing high to the swing low which can be seen in the picture below.

There are six (6) Fibonacci retracement levels that you need to know, namely:

- level 0.0%

- Level 23.6%

- Level 38.2%

- level 50%

- Level 61.8%

- levels 100% .

Some of these levels are used as reference areas or as references by traders in determining support and resistance areas. Among these levels, the Fibonacci levels that are quite popular are the 38.2%, 50%, and 61.8% levels.

In the range of one of these three levels, it often gives rise to buy or sell signals with a fairly high level of accuracy.

There is an interesting fact behind the 50% level. This level is not actually derived from the Fibonacci ratio, but many traders often pay attention to this level.

Why is that?

because price movements at these levels have a tendency to continue in a certain direction after crossing them.

If the price breaks the 50% level upwards, then the price rally will probably reach the 0.0% level. On the other hand, if the price manages to break through the 50% level to the downside, the price slump is likely to continue up to the 100.0% level.

The basic concept of using Fibonacci retracement is to look for buy opportunities when the price is in the support range and look for sell opportunities when the price is in the resistance range.

This strategy is similar to bounce trading. You wait for the pullback to reach the reference area and look for confirmation of a buy or sell signal.

A bounce in forex trading is the moment when the price bounces after approaching a support or resistance limit.

If you are still a beginner and haven't studied buy or sell signals in depth, you can use Fibonacci Retracements to help read price movements. When the price movement is stuck in the reference area, then you can try to sell or buy.

Then, how to apply a buy or sell strategy using Fibonacci? Let's first see how Fibonaci works in the following buy strategy.

Discussion About The Buy Strategy Using Fibonacci

Chart Movement With a Buy Strategy

You can use the Fibonacci reference area to look for buy levels during an uptrend. To give an idea of how to use Fibonacci in a buy strategy, you can pay attention to the example chart below, where the movement of GBP/USD occurred around November 3, 2011 to November 8, 2011.

|

| The Buy Strategy Using Fibonacci, foreximf |

On the chart, you already have a picture of the Fibonacci indicator with reference to the swing low at 1.59445 (100.0%) and the swing high at 1.60630 (0.0%). The yellow area becomes your reference area.

In this area, you can try to look for bounce confirmation, which is a buy signal, where in this area there are three retracement levels, namely:

60177 (38.2%)

60038 (50.0%)

59898 (61.8%).

These three levels become support while you are waiting for the price to enter the reference area. The best level to buy is around 61.8%. However, there are times when you will get a bounce confirmation of around 50.0%.

Then, at what level is it most suitable for you to take long positions? Take a closer look at this chart!

|

| The Buy Strategy Using Fibonacci, foreximf |

As can be seen in the chart above, the price movement repeatedly tried to break the level of 1.59898 (61.8%). It can be seen from this level that the test has been carried out four times, but the candlestick always closes above 1.59898.

This indicates that support in that area is quite strong, and it is time to buy around 1.60038 (50%).The target is at the level of 1.60630 (0.0%) while anticipation is at the exit point (1) or exit point (2).

What is the function of an exit point, and why should there be two exit points?

Exit points function to anticipate if the market will move otherwise and against your expectations.

Frequent price movements breaking the 76.4% level are an early indication that the trend direction will change, so some traders tend to choose to play it safe by releasing their positions after the level breaks (break).

However, confirmation of the trend direction change (reversal) is actually at the level of 100.0%, so traders who are more daring choose a break of that level as their exit point.

In addition, the important thing that you need to remember is that no technical analysis is 100% correct. Therefore, it is important for you to learn capital and risk management.

The combination of these three things will be a powerful weapon in your trading.

How does the GBP/USD end after buying?

|

| The Buy Strategy Using Fibonacci, foreximf |

If you see the price movement on the chart is declining, then this is the right time for you to release long positions at one of the two levels.

You will see GBP/USD going up and your target will be reached!

After you understand the use of the Fibonacci retracement indicator for this buy strategy in forex trading, now is the time for you to understand its use in the following sell strategy.

Discussion About The Sell Strategy Using Fibonacci

Sell Strategy Movement Chart

The sell strategy is actually the opposite of the buy strategy. If the buy strategy can be done during an uptrend, then this sell strategy can be done during a downtrend.

To see how to use the Fibonacci indicator in this strategy, you can see an example of price movement on the EUR/USD chart below!

|

| The Sell Strategy Using Fibonacci ,foreximf |

On the chart, you will be waiting for a pullback to occur to the sell reference area, which is in the range between 1.37461 (38.2%) and 1.38995 (61.8%). continued in the middle area where the level of 50.0% is at the level of 1.38228. These three levels are referred to as resistance levels.

How does EUR/USD end after selling?

|

| The Sell Strategy Using Fibonacci ,foreximf |

By the time the pullback has occurred, you can see that the price is already inside the reference area.

Notice on the chart, the price was unable to break above the level of 1.38995 (61.8%), even declined and broke below the level of 1.38228 (50.0%).

This is a good signal. You are allowed to sell with the target at the level of 1.34980 (0.0%). Don't forget to anticipate with a target at the exit point (1) or (2) in case your forecast is wrong.

|

| The Sell Strategy Using Fibonacci ,foreximf |

If you see that the price movement on the chart has increased, then this is the right time for you to release short positions at that level.

Not a few traders make mistakes in determining swing highs and swing lows by using this Fibonacci retracement indicator.

For the record, you need to observe carefully and practice on a demo account to hone your sharpness in recognizing these two positions. In addition, it takes more patience to wait for confirmation in the reference area in order to put this theory into practice well.

Post a Comment for "Get to know the Fibonacci Retracement Indicator."