|

| Futures Trading In Forex |

Futures trading has several differences compared to other forms of trading. It is these differences that are precisely the great attraction of futures trading.

In forex trading, you will be familiar with the terms 'two-way opportunity' and 'leverage', which you do not get in the form of trading financial instruments in general. In fact, even in stock trading it will be very difficult for you to find.

Two-way Opportunity in Forex Trading

In forex trading, prices always move dynamically. Interestingly, in futures trading you can take advantage of two directions of price movement, namely up and down. This means that you can still look for profit opportunities both when the price is moving up or down.

To get these benefits, of course you have to take a position (transaction) in the direction of the price movement. In the world of trading, this is known as a two-way opportunity.

The following illustration will clarify the scheme:

When you estimate the price will go up, then you can take a buy position (open a transaction). If your analysis is correct, and then the price moves higher, the more profit you will get.

Well, the question then is, "What if you previously predicted the price would move down?"

Here's what's interesting. If you expect the price of a commodity or trade subject to fall, then you can take a short position. If your analysis is correct, then the profit you will get will be even greater when the price of the commodity falls.

Your next question might be, “What if the price goes down after I take a long position, or the price goes up after I open a short position?”

The answer, of course, is that you will lose. That is why every transaction must go through the analysis process first. Equally important are “risk management” and “trading plan”.

If you have mastered these things, you will be able to optimize opportunities and minimize risks. You will learn more about these things on this forex education page.

Forex, Forex Trading, Indonesian Forex Brokers, Trusted Forex Brokers, Indonesian Forex Trading, legal forex brokers in Indonesia, legal forex brokers.

Leverage in Forex Trading

New term for you?

Don't worry.

You're in the right place to learn.

Imagine you are about to change your car's tire that has a puncture in the middle of the trip. Of course, you have to slightly raise your car a few inches above the ground. Of course it will be very heavy if you do it with your bare hands.

Fortunately there is a tool called a jack. You can elevate your car even using only one hand with the help of the jack. Without great power, you can already lift your car.

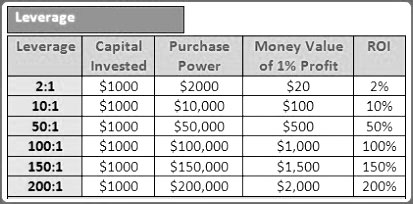

That's roughly how leverage works. With relatively small capital, you can make transactions with much larger capital. The leverage applied is 1:100 (one in one hundred).

If you want to make transactions worth USD 100,000 (one hundred thousand USD), then you only need one hundredth of the capital, which is USD 1,000 (one thousand USD).

The transaction value of USD 100,000 is referred to as the "contract size" or contract size. Meanwhile, the required capital, which is USD 1,000, is referred to as margin.

Suppose you make a transaction worth EUR 100,000 (one hundred thousand euros). The EUR/USD rate at that time, let's say in the range of 1.30000 (one point three), in other words: EUR 1 = USD 1.30000

This means that a transaction worth EUR 100,000 is equal to USD 130,000 (one hundred and thirty thousand USD). But with leverage (1:100), you only need a capital of USD 1,000.

Post a Comment for " Futures Trading In Forex"