We like to think that the fundamental rules of money management are simple: spend less than you earn and save some money for the future. In reality, however, it is rarely that simple. Money can be a complicated, emotional issue, which can influence how you save and spend.

Finding balance in your relationship with money, whether you identify as a spender or a saver, can be critical to living the life you want. So, how would you respond to the following question: Do you prefer to spend or save your money? The answer varies depending on when we were born for many of us.

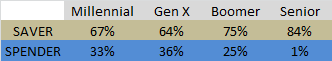

According to our most recent Couples & Money study*, roughly 7 in 10, people identify as savers, while only 3 in 10 identify as spenders. These figures differ by generation.

Older generations are less likely to consider themselves spenders.

|

| Source: Fidelity Couples and Money Study as of April 2021 |

"As we get older, our money mindset shifts: we are much more likely to feel less comfortable with money as young people, and then we become more protective and interested in money as we get older," says Megan McCoy, PhD, a licensed marriage and family therapist, an accredited financial counselor, and a Kansas State University professor of practice in personal financial planning.

Her studies are centered on financial therapy or the study of the relationship between money and emotions.

Another factor contributing to the shift toward saving could be a fully developed brain. "Our frontal lobe governs our ability to consider the long-term consequences of our actions. According to research, our frontal lobe does not fully mature until we are about halfway through our 30s "McCoy states.

So, is it possible to strike a balance between saving and spending throughout your life? Yes! You can begin by examining where you fall on the saving and spending spectrum.

Is it all in the brain when it comes to savers vs. spenders?

"According to brain research, when people identify as savers, the part of the brain that registers pain lights up more than when they spend. They literally suffer more from spending than others "McCoy states.

What makes us the way we are

"People have big money moments as they grow older and become adults. These moments can be good or bad, but they frequently leave an indelible mark on our relationship with money "McCoy elaborates.

"Our money experiences lead to our attempts to understand how money works in our lives and in the world," McCoy says.

While our early financial experiences may shape us, they do not have to define us for the rest of our lives. Consider your upbringing and experiences when deciding which money values to keep and which to discard. "Setting these types of money intentions can be a great way to calibrate your own money mindset," says Fidelity vice president Livia Binks.

How to Find the Right Balance Between Spending and Saving

If you want to develop new money habits, try some life hacks to get around your default response.

"The goal isn't to make you a saver or spender—the life hacks you create should be centered on balancing your natural instinct," McCoy says.

Spending Suggestions

- Taking your emotions out of financial decisions can help you build a solid savings foundation. Consider setting up automatic transfers to savings accounts with each paycheck and enrolling in your company's savings plan, if one exists. Then, every now and then, take a moment to rejoice in your continued savings success. Celebrating the little things can help you stay on track with your long-term savings goals.

- Spend cash rather than credit. Consider the envelope method for managing cash. The envelope system is a method of managing your spending to reach your savings goal and avoid using a credit card to pay for purchases if you are short on cash. After allocating cash to each envelope and assigning a spending category to each, the money in the envelope is all you get for each category until the next payday. When the money in the envelope is gone for the month, that's it. Any extra cash is put into savings. This method can also be done digitally by using an app or a spreadsheet. This can help keep you accountable, and research has found that taking money out of its designated envelope and using it for something else creates an additional level of mental resistance. It can help to write the category name and then seal the envelope.

- Engage in online shopping but do not purchase. Piling items in your cart can bring as much joy as actually purchasing them (and it's very easy to pile that cart high online). However, when all those boxes arrive, we may experience buyer's remorse. Rather than proceeding to the checkout page, place everything in your shopping cart and wait 24 hours. Then go back and decide what you truly desire—if anything at all. When the thrill of the click wears off, we often see things in a different light, says McCoy.

- Consider how long it will take you to work off what you buy. Your time is precious. It's critical to consider how much time each purchase consumes. "If I want to buy a large item, I might pause when I realize it will take 10 or even 20 hours to equal the pricewonder might wonder if it's worth it. It is at times "McCoy states.

Savings Strategies

- Put money in a separate spending account for fun. "Then, when you use the fun money, you should never feel stressed or anxious because you made a plan to ensure that the money is safe to use. And I believe that gives you some peace of mind "McCoy states.

- Consider non-cash payment options, as studies have shown that spending cash feels worse than spending with a credit card. If you pay off your bill on time every month, you might even come out ahead with a rewards or cash-back card.

Post a Comment for " Learn how to find the right balance between saving and spending."