What is the relationship between risk and money management in forex trading?

Risk is an accompanying factor in every business that will always be faced. The form of risk that is often faced by business people is loss. Not much different from other businesses that you are in. Even in trading, the risk will still exist.

Forex trading is a form of business that has a high potential for risk. Although we cannot eliminate the risk, it can still be "controlled". Including your trading risks, the profit opportunities offered are no less high.

To maximize the existing profit opportunities and at the same time minimize the occurrence of risk, risk management is needed, or more commonly known as "risk management."

With risk management, you can exercise full control over your money. As a trader, you choose complete control to limit the extent of losses that may be experienced.

Remember, no one can determine what will happen in their lives in the future, including forex trading. You never know what the market will be like in the future or where the price will move.

Therefore, it is important for you to have good risk management to minimize losses when trading. Most novice traders forget one of these important things, and in the end, the losses are quite a lot of traders' feelings.

Thus, it's a good idea as a novice trader to have good knowledge of risk and money management to help maximize your trading.

Then what kind of technique is important to know in this technique?

It's time for you to learn more about risk and money management!

1. Risk Management Tools You Should Be Aware Of

The Risk Management Method

In forex trading, there are 3 important methods of risk management that you can apply, namely:

cut loss,

Switching, and

average.

Cut Loss Method

Cut-Loss Method

This technique is done by closing losing transactions as soon as possible with the aim of avoiding the risk of greater losses.

For an illustration of the cut loss more clearly, you can pay attention to the illustration below.

At that time, you predict the price will go down and are ready to sell 1 lot at the level of 1.50000. However, unexpectedly the price moved up to the level of 1.50500, so you suffered a loss of-500 pips.

Because you don't want to face a bigger risk of loss, at the level of 1.50500 you closed the sell position with the consequence of experiencing a loss of-500 pips.

Switching Method

Switching Method

Switching is done by closing a losing position and immediately taking a new position in the direction of the next price movement. The goal is to recover losses caused by previous transaction positions.

Usually, this technique is effective when done when there is a rapid and drastic change in price direction. Take a look at the illustration below:

Suppose you open a short position at the level of 1.50000. But apparently, the price moved up to the level of 1.50500. In this position, you have suffered a loss of -500 pips.

If you think that the price movement will still increase, then at the level of 1.50500 you will close the short position. Then, at the same time, you open a long position at the 1.50500 level.

If it turns out that the price really continues to rise to the level of 1.51000, then your current position will benefit by +500 pips. That means the -500 pips loss due to previous short positions has been covered.

Keep in mind that to use this technique, you must be in a position that is very sure that the market will move quite fast.

Because by using this technique, you open another new position, which, of course, is overshadowed by the risk of loss if the market turns around again. The maturity of analysis and level of mental readiness also influence the success of this switching technique.

Averaging Method

Averaging Method

Do you have a strong mentality and are not afraid of risk?

Averaging can be one technique that you can use. Averaging (or also known as "cost-averaging") is a risk management technique that is quite extreme.

Why is it called extreme?

Because this technique essentially works "against" the direction of price movement.The basic idea is that it is impossible for the market to move in one direction forever.

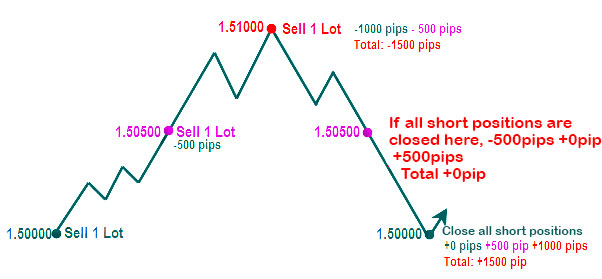

Take a look at the illustration above.

At that time, you sold 1 lot at a level of 1.50000.

When the price moves up to the 1.50500 level, instead of closing the losing position, you add another 1 lot short position. At this level, your loss has already reached -500 pips.

But apparently at that time, the price rose again to the level of 1.51000. So at this level, your total loss has become -1500 pips.

Your losses will only be covered if the price drops back to the level of 1.50500. If at this level you close all short positions, your loss will be zero.

If at that time the price fell back to the level of 1.50000, you would have made a profit of +1500 pips.

Keep in mind that this technique is not recommended for traders who have minimal funds because, as they see it, the risks involved are quite large.

Developments in Averaging Techniques

Averaging Technique

In addition to knowing about averaging, you need to recognize the three techniques developed from this strategy, namely:

- Pyramids,

- Martingale, dan

- Anti-martingale

The Pyramiding Method

Pyramiding Technique

Cost-averaging is the opposite of pyramiding.

If in cost averaging, one open position is added every time it experiences a loss, then in pyramiding, the open position is added every time it makes a profit.

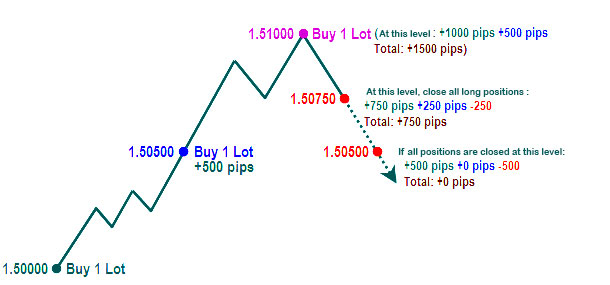

Examples, as you can see in the illustration below:

Every time you get a profit of 500 pips, you will add another buy of 1 lot. When the price drops from the 1.51000 to 1.50750 level, your total profit is still 750 pips. At this level, you can close all long positions at that time.

If the price drops to the 1.50500 level, then all your transactions will break even.

This technique can be effectively used if the market is in a trending state. However, this technique will not be effective if you use it if the market is in a sideways state.

The Martingale method

Martingale Technique

If you still feel that averaging is not an extreme technique, it's time to get acquainted with Martingale!

This technique is known to be very extreme compared to other techniques among average traders. With a martingale, you not only add a new position every time you experience a loss but also multiply the number of transactions.

In the illustration above, it is seen that you increase your short position by twice the previous position for every 500 pips increase.

If the price still rises to 1.51500, then you will increase the sell position by 8 lots. In the illustration, it is shown that a profit is earned when the price returns to 1.50500.

In contrast to the pyramiding technique, this technique is actually more effective when used when the market tends to be sideways.

However, an increase in the number of lots for each position will result in an increased risk. Therefore, you need to be careful and do the calculations correctly. If not, it is possible that the capital you have can be lost in an instant.

Method of anti-martingale

Anti-martingale technique

Anti-martingale is quite similar to the pyramiding technique. It's just that the number of transactions can be doubled for each additional profit. This technique will also be more effective if used when the market is trending.

For more details, you can see the illustration below:

It is important to continue to pay attention to price movements, lest the reversal direction make the profits you have collected turn into losses.

Are you familiar with this type of risk management?

If so, now is the time for you to learn more about money management, which is no less important!

2. Determine Financial Management

The Importance of Money Management in Forex Trading

Given the high risk that you will face in the market, it is important for you to have a proper fund management strategy.

Money management is one of the important factors in forex trading related to risk control. There are many things you can do to manage money, but the key is still risk limitation.

Then, what are the methods of capital management that you can apply?

Risk Amount Per Trade

The amount of risk per trade can be measured in monetary terms, not in pips, and is usually determined as a percentage of the capital or balance in your trading account.

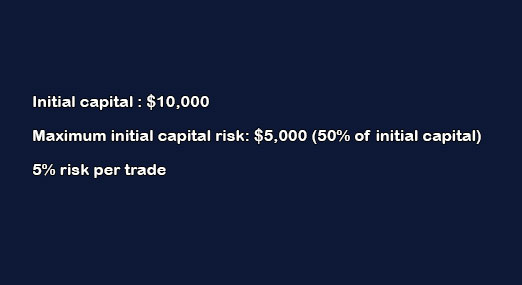

Assume you have $10,000 in your trading account. Then, you set the maximum risk for each transaction at 5% per trade.

This means, the maximum possible loss you will suffer on each transaction is 5% x $10,000 = $500.

In other words, the risk for each transaction you make should not exceed $500. If your first transaction suffers a loss, you will have $9,500 remaining.

However, if you wish to trade again with a risk limitation of 5% per trade, then the maximum risk for subsequent transactions is 5% x $9,500 = $475.

... and so forth.

The 5% risk limitation is based on the last capital owned. Therefore, you should also limit the maximum risk of the capital you have.

For example, with a $10,000 fund, you limit your risk by 50%. Then you should stop trading, or evaluate if you lost up to $5,000.

You can simplify the money management model described in the example above by using the following table:

- 1 500.00 9500.00

- 2 475.00 9025.00

- 3 451.25 8573.75

- 4 428.69 8145.06

- 5 407.25 7737.81

- 6 386.89 7350.92

- 7 367.55 6983.37

- 8 349.17 6634.20

- 9 331.71 6302.49

- 10 315.12 5987.37

- 11 299.37 5688.00

- Total 4312.00 (Loss)

Based on the capital management above, you have the opportunity to make 11 transactions before reaching 50% risk, with the assumption that all 11 transactions lose. Each loss is 5% of the last balance.

3. Recognize the Risk-to-Reward Ratio

Understanding the Risk-to-Reward Ratio

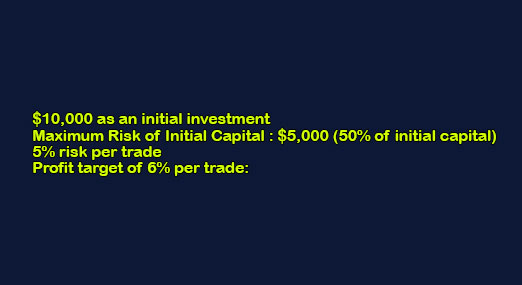

A Risk/Reward Ratio is a comparison between the amount of risk (stop loss) and the amount of profit target (reward) that you apply.

If you set a risk limit of 5% as in the example above, then it's best if the profit target is not smaller than the risk allocation. If the risk per transaction is 5%, then you can target a profit of around 6% or 10%.

As with risk, to set profit targets, there are no standard conditions. It's okay if you only target a profit of 5%.

But keep in mind, don't let the risk be greater than the opportunity you have. In other words, it is not wise to aim for a profit of only 4% while your risk is 5%.

This comparison between risk and potential gain is known as the "risk/reward ratio." If your transaction risk is 5% but the profit target is 10%, then the risk/reward ratio is 1:2.

The important thing to understand in this part of studying money management is to determine the amount of risk first, before finally calculating the profit that you will get.

4. Use of the Win-Loss Ratio

Understand the Win-Loss Ratio

No analysis is always correct. There will definitely be times when your predictions are wrong, and it is very possible to experience losses.

Therefore, it is important for you to have a trading system that has been studied and mastered carefully. Try the trading system that you use that has been proven to be profitable. In other words, the system has a level of accuracy that can be measured through a win-loss ratio.

A win-loss ratio is a comparison between profit and loss transactions.

For more details, you can look at the example below.

Your trading system made a five-times profit and a five-times loss in 10 consecutive transactions. This means that the trading system you are using has a 1:1 win-loss ratio.

Of course, a 2:1 win-loss ratio is better than a 1:1.

However, it should be realized that accuracy is not everything in trading. With the help of money management and a good risk/reward ratio, a 1:1 win-loss ratio can still result in accumulated profits.

Why is that so?

Let's take a look at the scenario the Example below presents:

Suppose the transactions that occur are as follows:

Trade P/L (USD) : Balance (USD)

- 1 -500.00 : 9500.00

- 2 -475.00 : 9025.00

- 3 541.50 : 9566.50

- 4 573.99 : 10140.49

- 5 -507.02 : 9633.47

- 6 578.01 : 10211.47

- 7 -510.57 : 9700.90

- 8 -485.04 : 9215.85

- 9 552.95 : 9768.81

- 10 480.00 : 10248.81

Total 248.81 (Profit)

For the record, the maximum risk per trade is 5% above. Depending on the market situation or the strength of the signals that emerge from your trading system, the transaction you make later may only allocate a risk of 4% or less.

Well, the question now might be: "How many lots per trade?"

Lot Size Per Trade (4.1)

With position sizing, the amount of risk in value will always be the same, including how much stop loss (risk in pips) you specify. For that, you need to return to the budgeting that has been set previously.

To give you an idea of the size of this lot per trade, you can look back at the scenarios below:

You have a capital of $10,000 with a risk limit per transaction of 5% ($500). Then your trading system shows a buy or sell signal, with a stop loss limit based on technical analysis (support or resistance) as far as 50 pips from the entry level.

Assuming that 1 pip is equal to $1 (mini account), it means that 50 pip stop loss is equivalent to $50.

In fact, the risk per transaction that you have applied is $500 (5% of $10,000). Thus, you can make transactions on 10 lots of mini accounts.

500 USD: 50 USD = 10 lots

Important Things You Need to Remember

Money management can work well if you master the trading strategy. Both are the main components of a trading plan that must be executed simultaneously.

Learning to maximize money management alone will not be enough if you have not been able to apply it in a disciplined manner. Money management will work well only if you have mastered and are confident in the trading strategy used.

By understanding it all, the targeted profit will be consistently achieved in the long term!

Post a Comment for " Risk and Money Management in Trading"