Wisely managing personal and family finances is everyone's dream, one of which is saving or investing. Investing is an option for some people to design a better future.

Invest in the right instruments that promise profits so that your income is no longer wasted on buying goods or paying for things you don't need. For those of you who are just starting to invest, looking for the right investment example is the first thing to pay attention to.

What is investment for beginners

|

| investment example for beginners, photo by pixels.com/Debraj Chanda |

Choosing an investment instrument without knowing for what financial purpose, is the same as buying a screwdriver without knowing what shape the bolt is, it can be a minus, plus or flower bolt.

The following are some examples of online investments that are suitable for beginners:

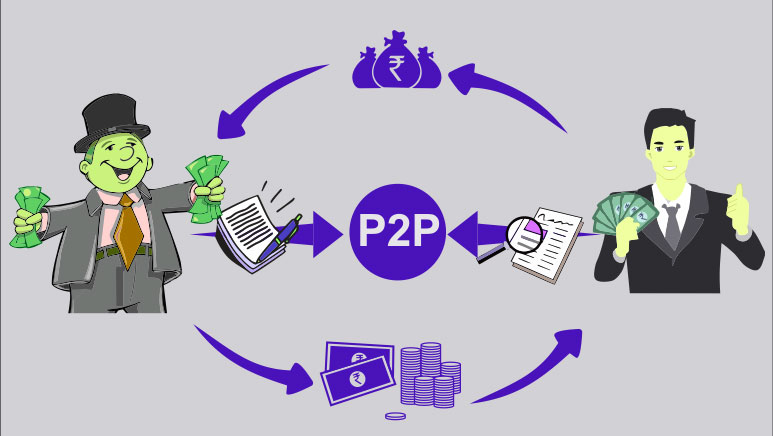

P2P (Peer to Peer)

|

| Peer to peer is an example of online investment |

P2P companies select prospective borrowers according to the criteria and determine the risk profile of the borrower, then place the prospective borrower into the P2P marketplace platform where investors choose the borrower to be funded.

Peer to peer provides the following investment benefits:

- The return offered is higher for investors because of the direct relationship between investors and borrowers.

- The value of P2P investment is relatively small and affordable, because the investment process is paperless with the help of technology. One of the P2P platforms accepts investments starting from IDR 10,000 per funding.

- The use of information technology makes the process of investing in P2P online and efficient.

What is important to note in this example of P2P online investment is the risk of default by the borrower, which is fully borne by the investor, while the P2P platform does not cover the default of the borrower.

Stock

|

| Warren Buffet investment |

Stocks are the most popular investment instruments issued and sold by companies for the purpose of financing the company's activities.

Shares are bought by people called investors. Investors who own shares have the potential to gain attractive benefits, namely dividends and capital gains. However, there is also a risk of investing in stocks, namely capital loss and liquidity risk

Stock price movements are measured by the Stock Price Index (JCI). If the stock price index rises, it means that the average stock price in the market has increased. Vice versa.

Interestingly, stocks are an investment instrument that you can do online. This is an example of investment under the Financial Services Authority (FSA) different in every country, and this is one example allowing the opening of accounts for online stock transactions to shorten account opening times and to increase financial inclusion, especially in the capital market.

The steps for making online investments such as stocks are:

- Select Stock Broker. You should choose a stock broker. There are many brokers or so-called 'Burse Members' who are members of the Indonesia Stock Exchange (IDX). Some brokers provide dummy-trades that you can use to evaluate whether the broker's stock trading application is good or not.

- Open a Stock Account. After choosing a broker, the next step is to open a stock account. Opening an account is mandatory because otherwise you cannot make stock transactions. Good brokers provide online account opening facilities where you simply fill out an online account opening form and send the document after it is signed.

- Open a Customer Fund Account. In addition to opening a stock account at a broker, at the same time as opening a Customer Fund Account (RDN). If a stock account allows you to buy and sell shares, RDN is a special account created at a bank to store funds for buying and selling shares. Capital deposits for share transactions and the proceeds from the sale of shares are stored in RDN.

All of the above steps in opening a stock transaction can be done online.

International Stock

In the current era of online trading, investing in stocks abroad is quite easy. The registration process and share buying and selling transactions are carried out through an online trading platform.

Why invest in foreign stocks? Stock investment is not only in the domestic market. Even financial theory suggests that stock investments in international markets. The reason is diversification. Investing in stocks in only one country is definitely more risky than investing in more than one country. With the example of investing in stocks in the international market, you can buy a global-scale company that promises not only profits but also a stable return.

Time Savings

An example of this investment is a savings account with interest above ordinary savings interest so that it provides greater profits. In one bank, the interest on term savings is 4.25% a year. However, the difference between term savings and ordinary savings is that in term savings there is a commitment not to withdraw money from savings within a certain period. If you withdraw money in a futures savings account before the end of the contract period, you must pay a withdrawal penalty to the bank.

What are the advantages of term savings?

Time saving has zero risk because it is a banking product so it is impossible for your money in term savings to be lost. Therefore, term savings are very suitable for short-term financial goals, for example, a child's down payment to enter kindergarten or elementary school which is needed in a matter of months. In the past, to open a term savings account, you had to come personally to the branch office of the bank concerned. However, now with the advancement of mobile banking applications, you can open term savings online at a bank's internet banking. Term savings are an instrument or example of an online investment that can help realize financial targets.

Mutual Funds

|

| Mutual Fund investment |

Some of the advantages of investing online in mutual funds include:

- The minimum investment in Mutual funds can start from $5, $10, or $100 can get you invested – a very affordable amount and one of the lowest among other investment examples.

- Many online Mutual fund investment applications are offered, which makes access to Mutual fund investments wide open for anyone.

The thing to note in the example of mutual fund investment is that before placing funds in a mutual fund, you must determine and confirm your financial goals.

There are so many choices of mutual fund types and managers on the market today, but for you to be able to navigate through these options and determine the most suitable investment model for which you need clear financial goals. You can use mutual funds to get more profit from your investment capital.

There are many options or many examples of mutual fund investments available. You can ask the investment manager to distribute according to the options that are right for you, and to make big profits from mutual funds, you must be good at analyzing the market so that you can make the best decisions.

The example above is an example of an investment that beginners need to follow.

Post a Comment for " This Investment Example Needs To Be Followed By Beginners"